On July 18th, our DeFiRanger system (https://arxiv.org/abs/2104.15068) reported a couple of suspicious transactions. After manual analysis, we confirm that these transactions are attacks to Array Finance. In the following, we will use an attack transaction to illustrate the attack process and the root cause of the vulnerability.

Attack Transaction

The attack transaction used in this blog is: 0xa17bbc7c9ab17aa88fdb5de83b41de982845e9c9c072efff6709dd29febf0daa

Attack Flow

As shown in Figure 1, we found that the attacker gained a profit of 186.62 WETH (we do not explicitly distinguish between WETH and ETH in this blog.) after borrowing the flash loan from AAVE.

The detailed attack process is shown in Figure 2.

- First, the attacker invoked the

buyfunction of the Array Finance. The attacker gained 430 ARRAY tokens minted by the Array Finance using 45.91 WETH. - Then the attacker invoked the

joinPoolfunction of a closed source contract (Array Collater - 0xa800cda5) five times. He/she deposited 676,410.58 DAI + 679,080.46 USDC + 901.82 WETH + 20 WBTC + 20 renBTC and gained 726.38 aBPT tokens minted by Array Collater. - The attacker invoked the

sellfunction to burn 430 ARRAY tokens and got 77.17 aBPT tokens. - At last, the attacker invoked the

exitPoolfunction of the Array Collater. He/she burned 804.55 aBPT tokens obtained in previous two steps and obtained 748,271.55 DAI + 751,225.08 USDC + 997.62 WETH + 22.63 WBTC + 22.74 renBTC.

From Figure 2, we can find the attacker gains profits in step 5 (Figure 2: Invoke the sell function). That's because the obtained 77.17 aBPT tokens are more valuable than the 49.9142 WETH deposited in step 3 (Figure 2: Invoke the buy function). In the following, we will analyze the code to understand why this attack can happen.

Code Vulnerability

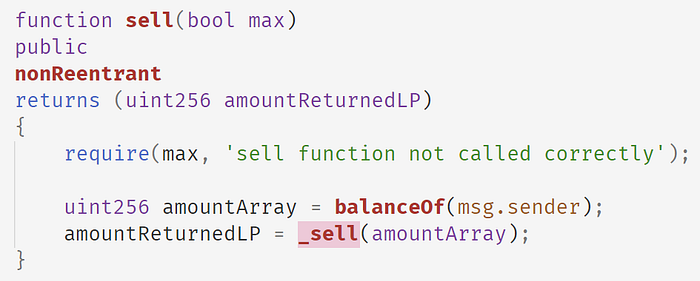

The following code shows the sell function of Array Finance. In this function, Array Finance uses the balance of the ARRAY token owned by the attacker and invokes the internal _sell function to calculate the number of aBPT tokens that can be obtained by selling the ARRAY token.

The following is the implementation of the _sell function. It invokes the calculateLPtokensGivenArrayTokens to get the number of aBPT tokens that can be gained given a certain number of ARRAY tokens. Then this function burns ARRAY token and returns the aBPT token.

The following shows the implementation of the calculateLPtokensGivenArrayTokens function.

Note that, there are four arguments that can affect the calculation of amountLPToken. After reading the saleTargetAmount, we infer the formula is as following:

The arraySmartPool is the smart contract address of the Array Collater ( 0xa800cda5). The value of arraySmartPool.totalSupply() will increase when the attacker deposits fundings borrowed from the flash loan into the Array Collater (shown in the following table).

We can confirm this logic after reading the code of the arraySmartPool. The following shows the joinPool function of the arraySmartPool.

This function first invokes the SmartPoolManager. joinPool function to calculate the number of tokens (actualAmountsIn) that need to be obtained from the msg.sender. Then for each token, it invokes the _pullUnderlying function to deposit the token to arraySmartPool. At last, it invokes the _mintPoolShare and _pushPoolShare to mint aBPT token and transfer the minted aBPT token to msg.sender.

Note that the arraySmartPool inherits from the PCToken. The _mintPoolShare function invokes the _mint function, which is shown in the following.

The _mint function will increase the varTotalSupply variable, which is directly returned by the totalSupply(). Thus, this value is increased for each invocation of the joinPool.

Profit Estimation

Summary

In summary, the attacker exploits the vulnerability that the price mechanism of the Array Finance depends on the totalSupply of the aBPT token, which is manipulatable. The vulnerability has been discussed in our research paper DeFiRanger: Detecting Price Manipulation Attacks on DeFi Applications.

Junjie Fei, Yufeng Hu, Zilin Lin, Siwei Wu, Lei Wu, Yajin Zhou @BlockSec

(In alphabetical order by the last name)

Medium: https://blocksecteam.medium.com/

Twitter: https://twitter.com/BlockSecTeam

Contact: contact@blocksecteam.com